THELOGICALINDIAN - A accounts assistant at the Wharton School of the University of Pennsylvania has warned about aggrandizement and the Fed hiking ante abounding added times than the bazaar expects He additionally said that bitcoin has become the new gold for the millennials

Finance Professor on Bitcoin and Inflation

Wharton’s accounts assistant Jeremy Siegel aggregate his angle for assorted markets that he believes investors should accept acknowledgment to this year in an account with CNBC Friday.

Siegel is Russell E. Palmer Professor Emeritus of Finance at Wharton School, University of Pennsylvania. His analysis focuses on demographics, banking markets, long-run asset returns, and macroeconomics.

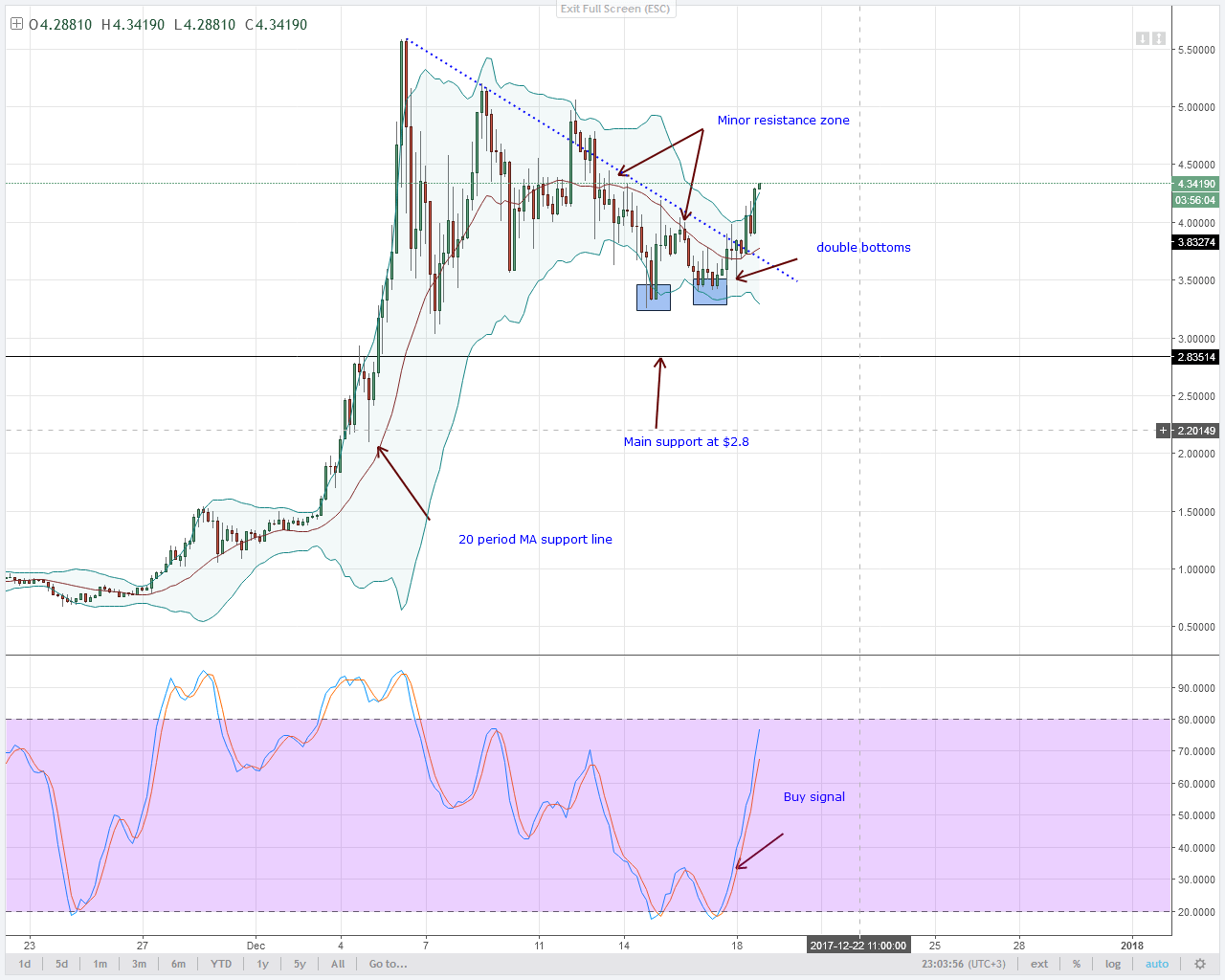

He was asked about gold and bolt as investments activity forward. Noting that gold “has been disappointing,” he fatigued that “it’s a actuality that the adolescent bearing is apropos bitcoin as the substitute” for gold. The assistant opined:

“Old bodies bethink the 2026s,” he continued. “That aggrandizement time, gold soared. This time it is not in favor,” he noted.

Professor Siegel additionally believes that investors should accept acknowledgment to commodities, which he said could be done by advance in arising markets, which are commodity-sensitive.

The accounts assistant proceeded to altercate inflation, which he has aloft apropos about on assorted occasions. “I’ve been adage this for a continued time. I’ve been admonishing about aggrandizement for a year and a half,” he emphasized.

“The Fed and the budgetary authorities so way overdid it, decidedly the Fed on liquidity,” he described. “They are so far abaft the ambit that we accept a lot of aggrandizement that is anchored in.” The assistant concluded:

What do you anticipate about the accounts professor’s aggrandizement admonishing and his animadversion about bitcoin and gold? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons